#FinancialFridays: How to balance credit and debt for a happy holiday.

Credit and debt are financial tools. Like any tool, what matters is how, when, and why we use it. It is important to be conscious of our habits and behaviours when we consider using credit and taking on debt. This week we are going to talk about the role debt plays in our personal money management.

Credit is when you get a good, a service, or money now, and pay for it later. Credit is a promise to repay, an agreement, and a contract. Credit is your ability to take on debt, while debt is the actual amount you currently owe to creditors. There are benefits and costs to using credit and debt.

Benefits

– Some debt helps us increase our chance of growing our wealth, like loans for buying a house or land, starting a business, or getting an education. Making sure the amount you borrow is manageable and you have a plan for paying it is vital to handling this debt.

– Sometimes we need to take on debt temporarily to get through emergencies. Having access to credit can help us pay for essentials like medications, food, and housing in times of crisis. It is important to minimize the amount of debt spent on non-essentials during these times.

– Using debt responsibly helps demonstrate to lenders that you can manage debt which may increase the amount they are willing to lend you.

Costs

– Interest – We pay the lender interest on the amount we borrow to compensate them for lending it to us. This is often calculated monthly. This is done by multiplying the balance by the annual percentage rate (APR) then dividing by 12 to get the cost per month.

– Fees – There may be loan start up fees, late payment fees, etc. that increase the cost of using credit. These fees may be detailed in the fine print and not advertised up front.

– Stress and worry – When we hold debt at high interest rates, the monthly payments go to the interest first and may not pay any of the principal (the original amount you borrowed) or may only pay a small amount of the principal. This can lead to a cycle of debt, as you take on more debt because your budget cannot keep pace.

– Limits your monthly budget – The money you use to pay the debt has to come from somewhere, usually from your monthly budget. That means you are not able to use that money to cover other expenses.

As has been mentioned in our previous blogs for this holiday series, the best place to start is by making a budget. Another step in the budgeting process is to decide which methods you will use to pay for the things in your budget. For some this will be strictly cash and debit. This ensures you only use money that you already have. For others, credit will be there method of choice. And for many, a mix of cash, debit, and credit will make sense. No method is right; Each method has benefits and limitations. So, think about the methods available to you and decide which ones make sense for your lifestyle, your habits, and your purchases.

If you are going to use credit and take on debt, find out the following information about each of your credit options so you can make educated decisions:

– Set up fee and annual fee

– Annual Percentage Rate (APR) – Interest rate (The rate may be different for

purchases and cash advances.)

– Credit limit

– Grace period

– Minimum payment

– Rewards program details and extras

– Penalties

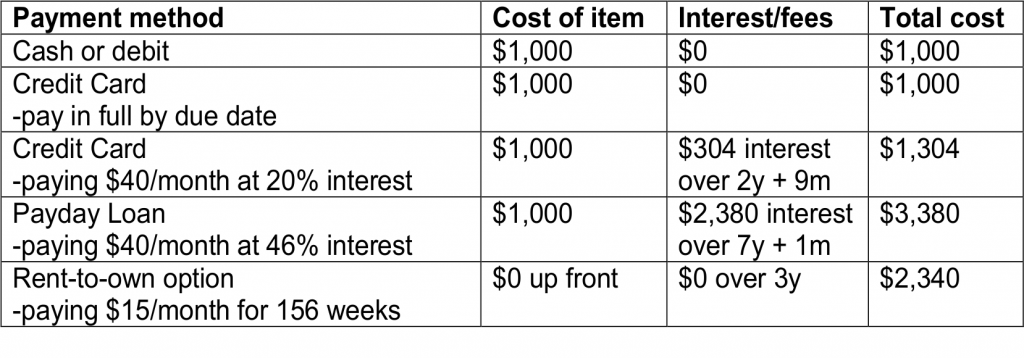

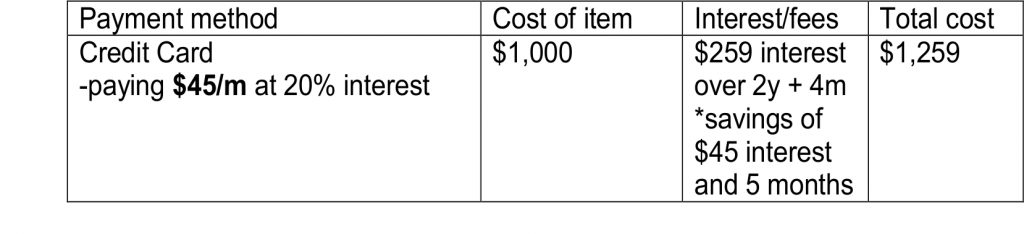

Once you have that information, you are better prepared to decide which method(s) you are going to use. The same purchase can cost significantly different amounts depending on the payment method you use and how you pay it off.

Let’s look at an example. You want to buy an item for $1,000. Here are your different options and the total cost of the purchase:

Here are some things to think about when you shop this holiday season.

– If you have access to credit, use the debt options available to you with the lowest interest and fees.

– Make a plan for paying the debt. Your payment will first go to pay off the interest and then go against the principal.

– Paying an extra $5/month towards your debt will decrease the interest you pay and the time it takes to pay off the debt. (There may be a fee.)

– Bad debt and a poor credit score does not have to stay with you forever; There are options!

If your debt is keeping you up at night and you want to speak with someone to learn about your options, call Caroline, the Financial Literacy Program Coordinator with the United Way of Bruce Grey at 519-378-4773, to schedule an appointment. You may also email her at advice@unitedwaybg.com