#FinancialFridays: An “Interest”ing Cupcake

Oh man, I love cupcakes. Mostly, I love the icing, and I guess the actual cake is okay too. And I like to treat myself to a fancy one once in a while.

But money right now is tight. Which made me wonder, “What would that cupcake cost me if I put it on my credit card?”

1 fancy cupcake will cost me around $4 including tax.

Grace Period

Credit cards have a grace period. This is the time during which you are not charged interest on your purchases.

If I pay my credit card before the end of the grace period, the cupcake will still cost me $4.

After Grace Period

If I don’t pay by the end of the grace period, I will be charged interest on the cost of my cupcake.

This is how you calculate your monthly interest rate on the balance of your credit card.

- Find your current APR and your balance in your credit card statement. The Annual Percentage Rate (APR), also known as Annual Interest Rate is the yearly interest rate you’ll pay if you carry a balance on your credit card. Balance is anything above $0 that you owe to the credit card company.

- Divide your current APR by 12 (for twelve months of the year) to find your monthly periodic rate. The periodic rate is the interest you are charged for each period, usually monthly with credit cards.

- Multiply the periodic rate number by the amount of your current balance.

Here we go.

- The APR on my credit card is 20.99% and the balance, in this case, is $4 for a cupcake.

- 20.99 ÷ 12 = 1.75. To make this a percentage, move the point two spaces to the left. = 0.0175

- $4 X 0.0175 = .07

If I leave the cost of the cupcake on my credit card as a balance of $4, I will be charged $0.07 of interest. My cupcake has now cost me $4.07.

After several months

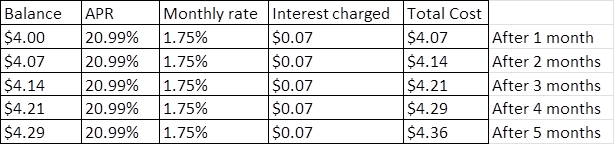

What if I leave the cost of the cupcake and the interest on my credit card for 5 months?

Credit cards charge compound interest. Compound interest means you are charged interest on both the balance on your credit card and the interest you have already been charged. I find the math formula for this confusing, so I found an online compound interest calculator.

https://www.calculatorsoup.com/calculators/financial/compound-interest-calculator.php

Here we go again. This is how compound interest would change the cost of my cupcake.

After 5 months, my $4 cupcake plus the compound interest I will be charged equals $4.36. My $4 cupcake has now cost me $4.36.

But, people don’t just use their credit cards for cupcakes…

If my current credit card balance is $1,000 and I don’t pay it for 5 months, I will be charged $90.57 in compound interest.

If I pay the minimum payment on my credit card, I will pay off the interest each month and a minimal amount of the balance.

If I pay the minimum payment plus $1, I will pay off the interest and start to pay down the balance.

Credit is complicated and credit card companies make money from the interest they charge you. The longer they can charge you interest on your purchases and the interest, the more money they make.

The Government of Canada has a simple Credit Card Payment Calculator. To play around with numbers and see how they will change your debt, visit https://itools-ioutils.fcac-acfc.gc.ca/CCPC-CPCC/CCPC-CPCC-eng.aspx.

If you are dealing with debt, or trying to avoid it, and want to speak with someone about your options, reach out to our Financial Literacy staff member.