#FinancialFridays: Using a Calendar to Budget

Budgeting can seem daunting, overwhelming, and scary. People have strong reactions to the word budgeting. How often was money talked about in your family? Where are these calm, straightforward, realistic conversations? Not in my house. Many people manage their money based on their emotions and thoughts. This can be useful for some. For others, having a clearer picture of their financial situation would be helpful, and a budget can help them do that.

A budget is a tool. It doesn’t judge you, worry about you, get excited, or anxious. It is a tool that shows your current financial situation. With that clarity, can you make decisions based on information?

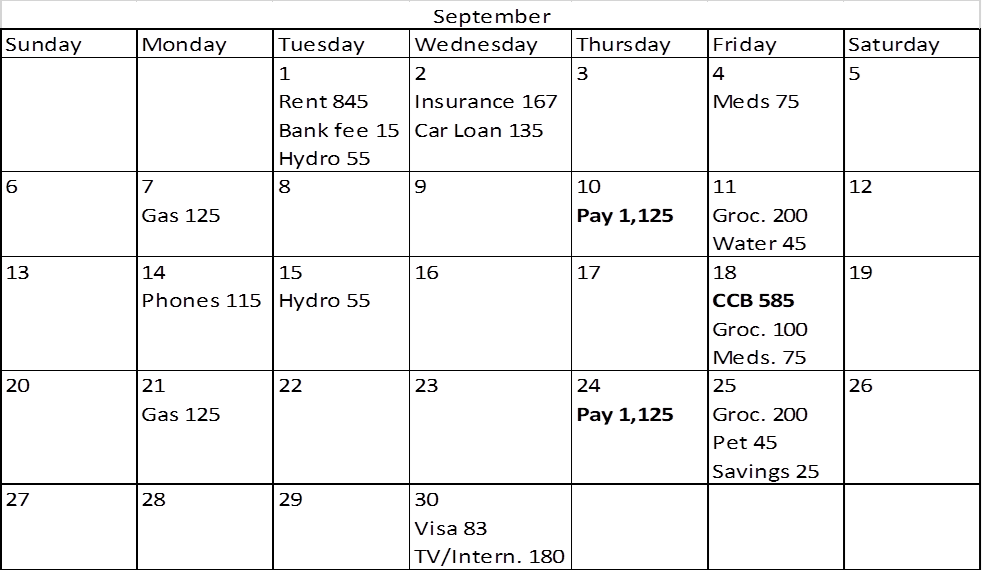

One simple way to make a budget is to use a calendar. There are sometimes free calendars are the end of the check-out line or at your doctor’s office. Here is an outline of that Calendar Method of budgeting. Give it a try; If it doesn’t help, try something different.

| Calendar method |

| •You will need a calendar and two differently coloured markers/pens |

| •With one colour write all the income that will come in on the dates it will come in. |

| •With the other colour write all the bill payments on the dates they need to be paid. |

| •This will help you see when and the amounts of money flowing into and out of your accounts. |

Once you do that, spend the next month tracking your income and expenses. At the end of the month, compare it to what was on your calendar.

| •Answer the following questions: |

| •What did we stay on track with? Why? (What helped you stay on track?) |

| •What did we get off track with? Why? (What happened to get you off track?) |

| •What do we need to change to stay on track next month? |

This takes learning and continual tracking. Don’t beat yourself up for getting off track; Learn from it. What one thing can you do differently the next month?

Here’s an example of a calendar used for budgeting: