#FinancialFridays: Know your Debt

Debt comes in two forms, secured and unsecured.

Secured debt means there is a physical thing that can be taken if the debt payments are not made. If you have a house and don’t make your mortgage payments, the house may be taken away from you. If you have a car and you miss car loan payments, the car may be repossessed. If you have a desk, bed, or TV through a lease-to-own company and you miss payments, the items may be taken away. The debt is secured against the item.

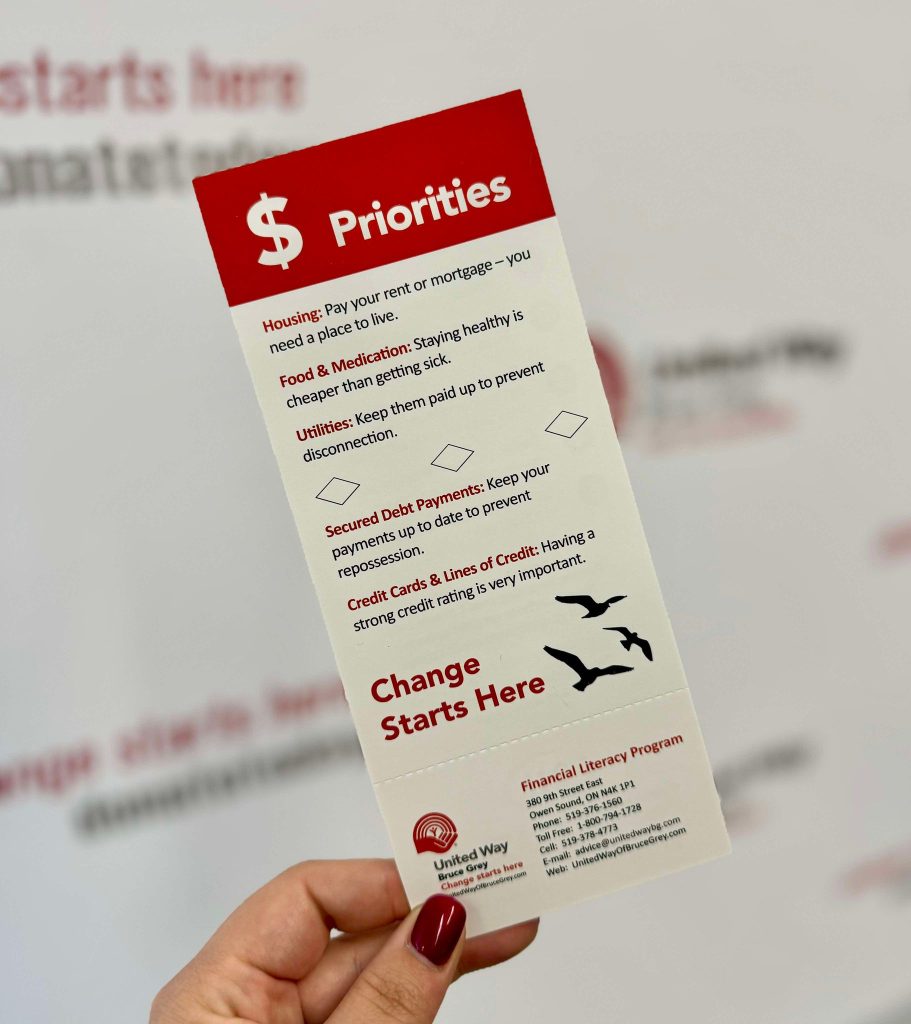

When you are prioritizing payments to make, think about the secured item and if you still need it. If you don’t, it may be time to sell the item. If you still need the item, making that payment a priority will help you keep that item. If you need a car to keep getting to your appointments, it may be a high priority payment. If you have alternatives to getting where you need to, the car payment may be less important than other payments. It depends on your situation.

Some credit cards are secured. This means you gave the credit card company a sum of money upfront. You then get to borrow that money to buy things on the secured credit card. The company then reports how you use the credit to a credit bureau. The reason you do this is to build a history of using credit to help build your credit report and credit score (which is done by one of the two credit bureaus in Canada, TransUnion or Equifax).

All other debt is unsecured. This means there is no item that is taken away.

A Line of Credit is a loan from a bank or other financial institution that lets you borrow money for purchases. Some lines of credit are secured against your house. These usually have lower interest rates than unsecured lines of credit.

Whether a debt is secured or unsecured, making your payments on time and at least the minimum payment amount, will usually keep you in good standing with the creditor.