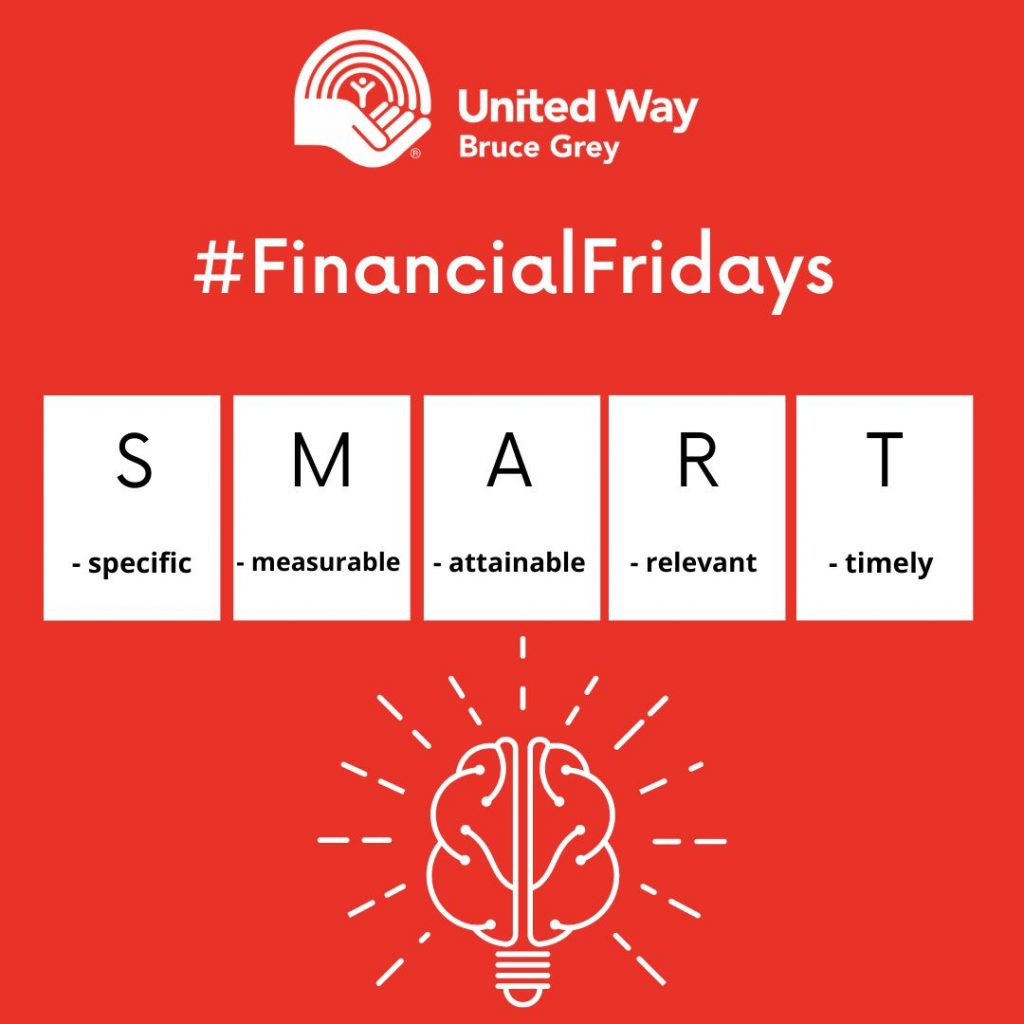

#FinancialFridays: Be SMART

S.M.A.R.T.

Specific

What do you want to achieve? Start with outlining detailed goals and be clear about what you want. Being precise about each goal you want to accomplish, and how you want to get there, can help motivate you to stay the course.

Measurable

If you can see it, you can do it. Use a financial calculator to gauge your progress and calculate what you still need in order to achieve your goal. Seeing your progress will help keep you motivated and committed to achieving your goal.

Attainable

Your goals can be challenging, but they shouldn’t be impossible. Be realistic about what you want to accomplish and do enough research to decide if your goal is achievable under your timeline. If it seems like it’s out of reach, adjust some variables to make it attainable. Work to balance out the variables to make your goal realistic and achievable.

Relevant

Your financial goals should be personal to you. The road can get pretty rocky if you don’t enjoy the journey, so don’t choose arbitrary goals. Furthermore, you’ll need to decide what resources will be put toward your goal. How will this affect other areas of your life?

Timely

Any goal should have a time stamp. A deadline helps create a sense of urgency and priority. It also gives you something to look forward to a realistic end date.

If you can approach your financial planning honestly and objectively, using something like the SMART criteria, you can be more confident that you’re on track with your overall financial plans and on your way to that ideal retirement.