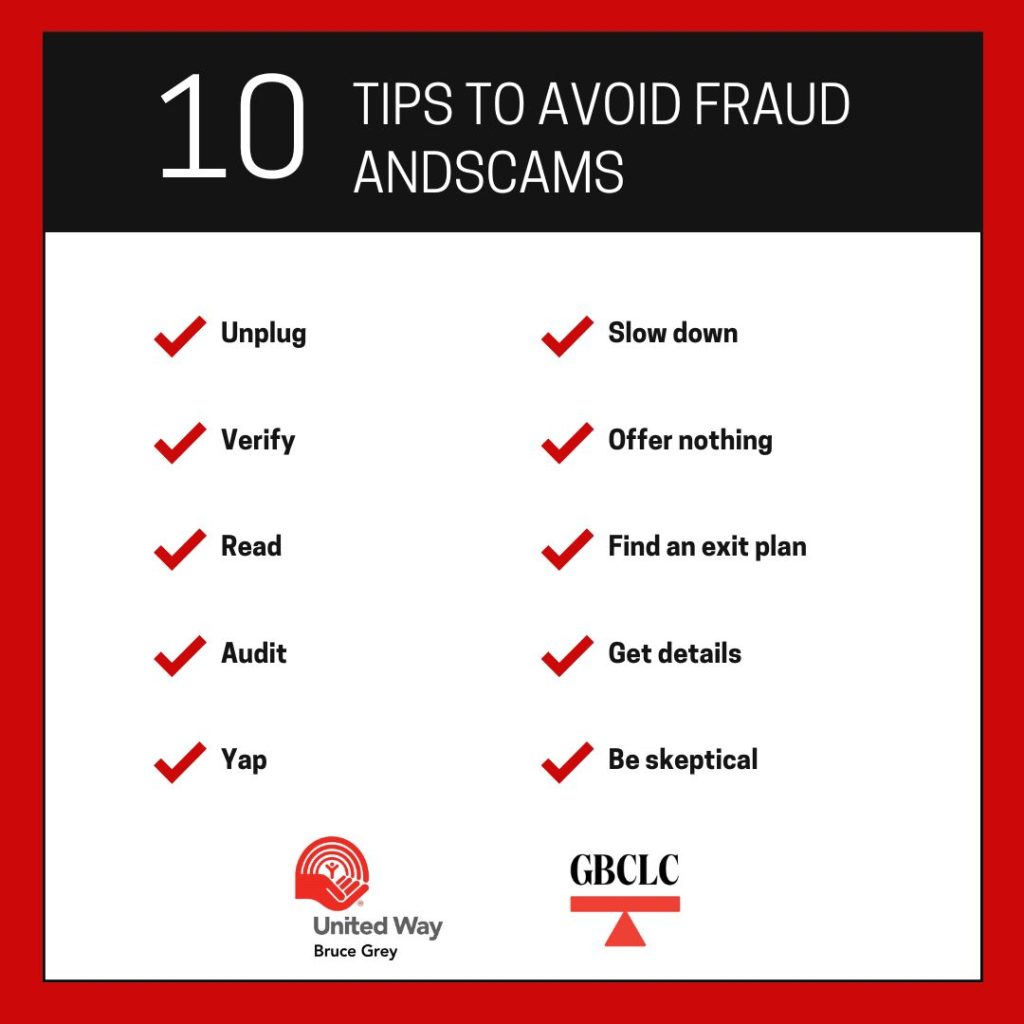

#FinancialFridays: 10 Tips to Avoid Fraud and Scams

This blog is the second in our four-week series about financial elder abuse. This week we are focusing on fraud and scams. Fraud and scams are people lying to trick other people out of their money and or possessions. Here are some examples of fraud and scams.

- pretending to be a person in authority, such as a government employee, and telling you that you must pay money

- signing your name on a piece of paper to get a loan under your name

- telling you that a family member is in trouble and you must send money somewhere to help your family member

The Grey Bruce Elder Abuse Prevention Network has made a list of ten tips to help seniors protect themselves from fraud and scams.

- Unplug — Do not answer unknown emails, text messages, phone numbers, or online links. Do not answer messages with many grammar and spelling mistakes because such messages are usually scams. If you let your phone calls go to voicemail to avoid scams, you should put your name on your voicemail recording. Important callers, such as health care workers, cannot leave messages for you unless they know they have reached your voicemail.

- Verify – Research the situation before sending money. For example, if you receive a phone call that a family member is in trouble and needs money, call a family member to find out if that information is true before sending money. Find out if businesses have been reported to the government for not following customer service standards before you sign up to get services from the businesses. For financial businesses, such as mortgage brokers, look at the website for the Financial Services Regulatory Authority of Ontario: https://teao.fsrao.ca/. For all other businesses, look at the Consumer Beware List: https://www.ontario.ca/page/search-consumer-beware-list

- Read — Do not sign any papers unless you read them and understand what you are signing, including agreements on websites. If the papers you have been asked to sign are not clear to you, ask a friend or family member to read it too or contact the Grey-Bruce Community Legal Clinic to help you understand the papers. The Legal Clinic can be reached by phone at 519-370-2200 or 1-877-832-1435. You can also contact the Legal Clinic by email at general@gbclc.clcj.ca.

- Audit – Check your bank accounts, credit cards, and credit score regularly to watch for problems. Set up alerts, such as text or email messages, to tell you about activities on your bank accounts and credit cards so you will know quickly if withdrawals or charges have happened that you did not make. The faster you tell your bank or credit card company that you did not withdraw money or buy an item, the easier it will be to get your money back.

- Yap – Ask for opinions about the situation from a trusted person in your life, such as a friend or family member. You can also contact police, the Canadian Anti-Fraud Centre (1-888-495-8501), or Consumer Protection Ontario (1-800-889-9768) to ask if the situation seems to be a fraud or scam.

- Slow down – Do not rush to send money. Fraudsters and scammers try to make people feel panicked so they will not take the time to ask questions and think about whether sending money or buying an item is a good idea.

- Offer nothing – Do not give your passwords, credit card information, or other personal details over the phone, email, or social media. Do not get rid of papers with your personal information in the garbage or recycling unless you have shredded them or cut them into tiny pieces so the information cannot be identified.

- Find an exit plan – Know how you can cancel an agreement to buy a product, service, or investment before you sign up. Legitimate sales agreements will tell you when and how the agreement can be cancelled.

- Get details – Ask questions to get as much information as you can about the situation. For example, if someone is claiming to give you a great deal to buy something, ask for details about the person or company selling the item. Fraudsters or scammers will sometimes give up trying to trick you if you ask for a lot of information. Do research to find out if any information you are given is true before you sign up for a product or service or send money to someone. Your bank might be able to help with that research. You can also contact the places listed in tips #2 and #5 above to do research.

- Be skeptical – Do not trust any information you are given. If something seems too good to be true, it probably is not true. Comments that terrible things will happen unless you do something right away are probably also not true. Always do research to find out if the information is true before you send money. For example, fraudsters and scammers are now able to make it look like they are calling from phone numbers that are not their real phone numbers. They can also put together conversations from audio recordings they find on the Internet. It is possible that you could receive a phone call that your call display says is a family member’s phone number and then hear their voice but the whole situation is a scam. The fraudster is calling from another phone number and found recordings of your family member’s voice on the Internet that the fraudster used to create a conversation in your family member’s voice. Create a code word with your family members that they will share with you if they are talking to you about money so you will know it is actually your family member calling.

Even if you follow all of these tips, it is still possible that you could be the victim of a fraud or scam. For example, fraudsters and scammers sometimes steal personal information from companies about their customers, such as their credit card numbers. Next week’s blog will discuss what to do if you are the victim of a fraud or scam.