#FinancialFridays: Filed, Finalized and Flowing

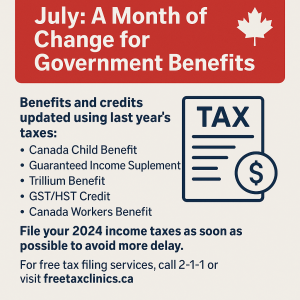

July is the month of change… for government benefits.

The government uses taxes from the previous year to determine if you are eligible for benefits and income.

These include:

- Canada Child Benefit

- Guaranteed Income Supplement

- Trillium Benefit

- GST/HST Credit

- Canada Workers Benefit.

If you have NOT filed your taxes, you may not see these benefits in your account in July!

For those 65 and older, if you have used the Seniors Co-payment Program to lower the cost of your prescription drugs paid for through the Ontario Drug Benefit, your continued eligibility for the Co-payment Program is also being assessed. If you haven’t filed your 2024 Income Taxes or are deemed ineligible, the $100 deductible comes into effect in August 2025.

If you filed your 2024 Income Taxes by April 30th, 2025, the government has had time to review

- If you are eligible for the benefits and

- The amount you will receive.

If you filed your 2024 Income Taxes after April 30th, 2025, it may take some more time to for the government to determine your eligibility. There is not much more you can do to speed that process along.

If you have not yet filed your 2024 Income Taxes, file them as soon as possible to avoid more delay.

For individuals with an income of $35,000 or less and simple tax situations, you can access free tax filing services. Call 2-1-1 or visit freetaxclinics.ca for more information. Services are limited outside of March and April, but there are some available.